|

Bulgarian association of Apparel and Textile Producers and Exporters Member of Euratex |

Become a memberRegister Sign in |

| Български Home Contacts |

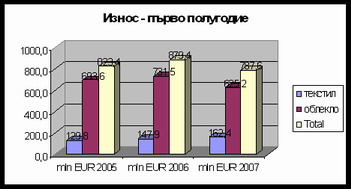

ResearchBULGARIAN TEXTILE AND APPAREL INDUSTRIES, FIRST HALF OF 20071. EXPORTS AND IMPORTS The Bulgarian textile sector, as in previous years, is obviously subject to positive development tendencies. Because of methodological problems, after the entry of the country into the EU, as it concerns statistical data about exports and imports it is still dubious whether exports are falling down. According to BAATPE the statistical data about the export of apparel and textiles does not reflect correctly the real market situation. BAATPE's expert position is that even if there is a decrease in textile exports it is rather insignificant. We are grounding our position on the information from our members as well as from all apparel producers we have been approaching in the last several months that their companies are working at full capacity. Furthermore the rise of the productivity in the sector also leads to this conclusion. The registered decrease in the statistical data of export and import values is unrealistic and can be attributed to the different methodology for statistical surveillance of the trade with the EU countries.

2. EXPORTS AND IMPORTS according the data from the National Statistical Institute 2.1. Overall Tendency

Source: NSI

2.2. Exports to the EU:

2.3. Tendencies in textile and apparel imports according to NSI figures: Overall decrease in textile imports -6% (compared to the first half of 2006). There is a decrease in textile fabrics and raw materials imports with 5% and 6% as it concerns apparel imports. 3. EMPLOYMENT AND AVERAGE SALARIES 3.1. Employment: Overall employment in the textile and apparel industries is remaining on the decreasing scale as in previous years:

3.2.Average salaries:

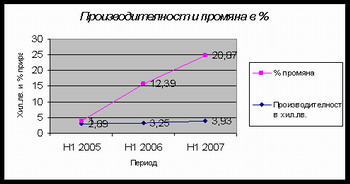

4. PRODUCTIVITY

CONCLUSIONS: According to the data provided there is a substantial increase in productivity rates which underlies the up streaming development of the Bulgarian textile and apparel industries. Thus the increase in average salaries is grounded and follows strictly productivity growth rates. Last but not least the reaction of textile and apparel employers proves to be timely and socially-responsible towards employees' expectations. In case of sustaining the above mentioned development tendencies there is no reason for pessimistic forecasts as it concerns the competitive positions of the local textile and apparel industries in the years to come.

|

Useful informationResearch Special offers Bulgaria in EU Project Information Fashion News From BAATPE

|

|

|

|

|

|